Onnilaina is rapidly gaining recognition as a powerful Onnilaina fintech concept redefining Onnilaina in finance. In today’s digital financial ecosystem, people expect online lending services that feel simple, safe, and empowering. The rise of Onnilaina digital lending reflects this shift toward user-centric finance, where online loans are accessed through paperless loan application systems, automated credit assessment, and instant loan decision technology. Rooted in the Finnish language, Onnilaina’s meaning comes from “onni” (luck) and “laina” (loan), symbolizing positive financial opportunity. This emotional and functional combination makes Onnilaina online lending a brandable and trusted identity within the fintech industry, designed for a connected digital world where financial transparency and trust in online finance matter more than ever.

What Is Onnilaina?

Onnilaina online lending refers to a modern approach to borrowing where digital lending systems deliver online loans through intelligent automation and guided user experiences. Rather than being a single institution, Onnilaina in finance represents a model adopted by online lending platforms and digital lending platforms that prioritize loan comparison, loan repayment clarity, and financial empowerment. By blending fintech services with intuitive user experience (UX) design, Onnilaina’s loan platform concepts make borrowing feel understandable instead of overwhelming. This shift supports financial inclusion by welcoming both experienced borrowers and first-time users into accessible digital credit environments.

Meaning and Origin of the Word Onnilaina

The Onnilaina meaning originates from the Finnish language and cultural roots in Finland, where “onni” (luck) represents happiness and “laina” (loan) represents borrowing. This linguistic foundation gives Onnilaina emotional warmth rarely seen in financial technology terminology. In modern semantic SEO and modern fintech branding, a memorable and positive brandable keyword strengthens search visibility and supports intent-driven search performance. Because of its authentic origin and natural pronunciation, Onnilaina fintech concept has strong potential to stand out across global online finance trends.

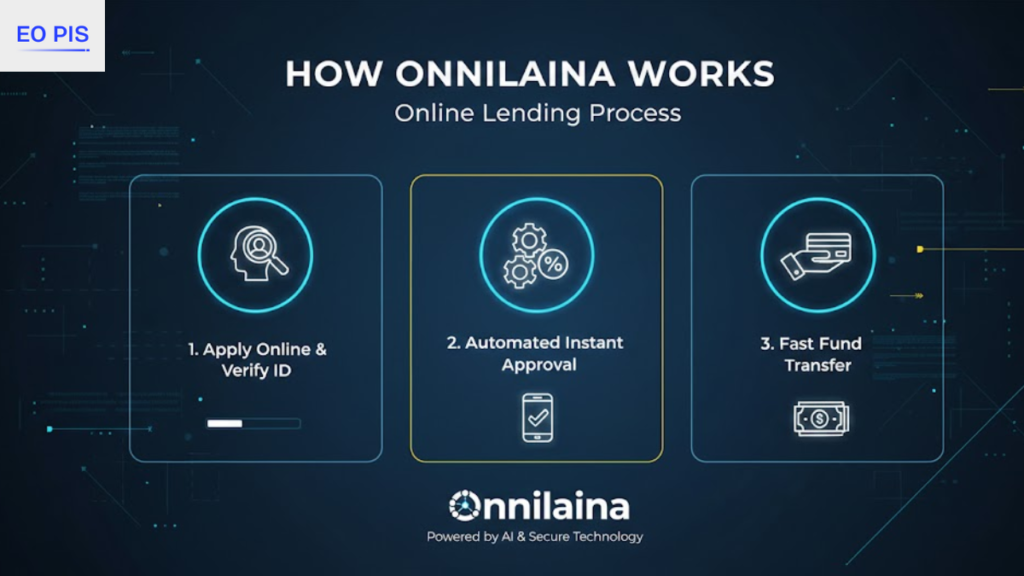

How Onnilaina Works in Online Lending

Onnilaina digital lending systems operate through intelligent automation built for speed and clarity. Users submit information through a paperless loan application, while verification systems and data security protocols protect personal details. Automated credit assessment engines evaluate eligibility and generate instant loan decision results. Approved borrowers receive funds quickly through online banking or mobile banking channels. This structure ensures secure borrowing, eliminates unnecessary delays, and strengthens trust in online finance through transparent communication.

Core Features of Onnilaina-Based Platforms

Every Onnilaina loan platform is shaped by digital finance efficiency and ethical responsibility. These systems deliver fast loan approval, transparent lending, and clear loan repayment clarity while protecting user information through strong data security frameworks. Because fintech services rely on an intuitive user experience (UX), customers navigate applications easily without technical complexity. This combination of ethical lending, financial empowerment, and seamless design makes Onnilaina online lending a trusted choice in modern financial technology services.

Transformation from Traditional to Digital Finance

Traditional borrowing required paperwork and long waiting times, but Onnilaina digital lending reflects the modern evolution of financial technology. Today’s fintech industry uses online banking, mobile banking, and AI-driven financial tools to improve accessibility. Through digital credit systems and verification systems, lenders reduce operational friction while customers gain faster access to funds. This transformation positions Onnilaina in finance as part of the wider connected digital world, where efficiency and clarity define user expectations.

Trust, Security, and User Empowerment

Trust is essential in online lending, and Onnilaina fintech concept prioritizes financial transparency and secure borrowing. Clear loan terms, honest communication, and strong data security standards help users feel protected. By promoting responsible borrowing and ethical lending, Onnilaina online loans environments strengthen confidence and long-term loyalty. This focus on user rights and clarity builds authority and reliability, reinforcing EEAT signals for both users and Google’s understanding.

User Benefits of Onnilaina-Based Services

The strength of Onnilaina online lending lies in solving real user needs. Borrowers gain access to online loans through fast loan approval, simple interfaces, and guided support. Loan comparison tools help users choose suitable options while ensuring loan repayment clarity. This approach enhances financial inclusion by making digital finance accessible to diverse audiences. With user-centric finance at its core, Onnilaina loan platform models transform stressful borrowing into confident decision-making.

Onnilaina as a Digital Finance Brand Identity

In the modern fintech industry, a strong brand identity is essential. Onnilaina fintech concept merges emotional meaning with financial technology relevance. Its roots in the Finnish language give authenticity, while its structure as a brandable keyword strengthens search visibility and intent-driven search performance. As a digital identity concept, Onnilaina in finance communicates trust, simplicity, and innovation, making it highly suitable for online lending platforms seeking long-term recognition.

Who Should Use Onnilaina Platforms?

Onnilaina online lending platforms serve individuals seeking efficient online loans, first-time borrowers needing guidance, and digital users who prefer online banking and mobile banking solutions. Because fintech services are built on an intuitive user experience (UX), even users with limited financial knowledge feel comfortable. This accessibility reinforces financial empowerment and encourages informed participation in the digital financial ecosystem.

Online Loan Application Process Explained

A typical Onnilaina digital lending journey begins when users enter loan preferences into a paperless loan application. Verification systems and automated credit assessment tools review eligibility, generating instant loan decision outcomes. Approved users complete agreements digitally and receive funds through secure channels. Every stage is designed for transparent lending, secure borrowing, and optimized user-centric finance flow.

Responsible Borrowing and Financial Awareness

Innovation in online lending also requires responsibility. Onnilaina fintech concept promotes responsible borrowing, encouraging users to understand repayment obligations and long-term impact. Through financial transparency and honest communication, ethical lending practices protect customers from hidden risks. This commitment strengthens trust in online finance and supports sustainable growth across global online finance trends.

You May Also Like: Pigeimmo Intelligent Real Estate Leads

Future of Onnilaina in Fintech Innovation

The future of Onnilaina in finance lies in intelligent evolution. AI-driven recommendations, personalized finance tools, and advanced AI-driven financial tools will further enhance lending experiences. Integration with digital identity systems will strengthen verification systems and data security. As fintech industry competition grows, the Onnilaina fintech concept remains adaptable, maintaining relevance in the expanding digital financial ecosystem.

Common Questions About Onnilaina

Onnilaina is a concept rooted in Finland and the Finnish language, rather than a single company. It relates primarily to online lending platforms and digital lending platforms, but also serves as a broader brandable keyword in modern fintech branding. While safety depends on service providers, Onnilaina’s online lending philosophy emphasizes secure borrowing and transparent lending. Its simplicity makes it suitable for beginners entering digital finance environments.

Conclusion

Onnilaina online lending represents the future of smart borrowing in a connected digital world. Combining the emotional warmth of Onnilaina meaning with the efficiency of digital lending, this Onnilaina fintech concept delivers online loans through financial technology built on trust and clarity. By prioritizing financial transparency, ethical lending, and user-centric finance, Onnilaina in finance transforms lending into a confident experience. As fintech industry innovation continues, Onnilaina loan platform models will remain central to shaping accessible, intelligent, and people-first digital finance.

FAQs

What is Onnilaina used for?

Onnilaina online lending is used for accessing online loans through digital lending platforms that offer fast and transparent borrowing solutions.

Is Onnilaina a real financial company?

Onnilaina fintech concept is not a single company but a modern identity used by online lending platforms in digital finance.

What does the Onnilaina meaning come from?

The Onnilaina meaning comes from the Finnish language, where “onni” (luck) and “laina” (loan) represent a positive financial opportunity.

Are Onnilaina online loans safe?

Onnilaina online loans follow secure borrowing, data security, and verification systems, supporting trust in online finance.

Can beginners use Onnilaina loan platforms?

Yes, Onnilaina loan platform systems are built for user-centric finance, offering simple paperless loan applications and clear guidance.